1MG FlippingBooks

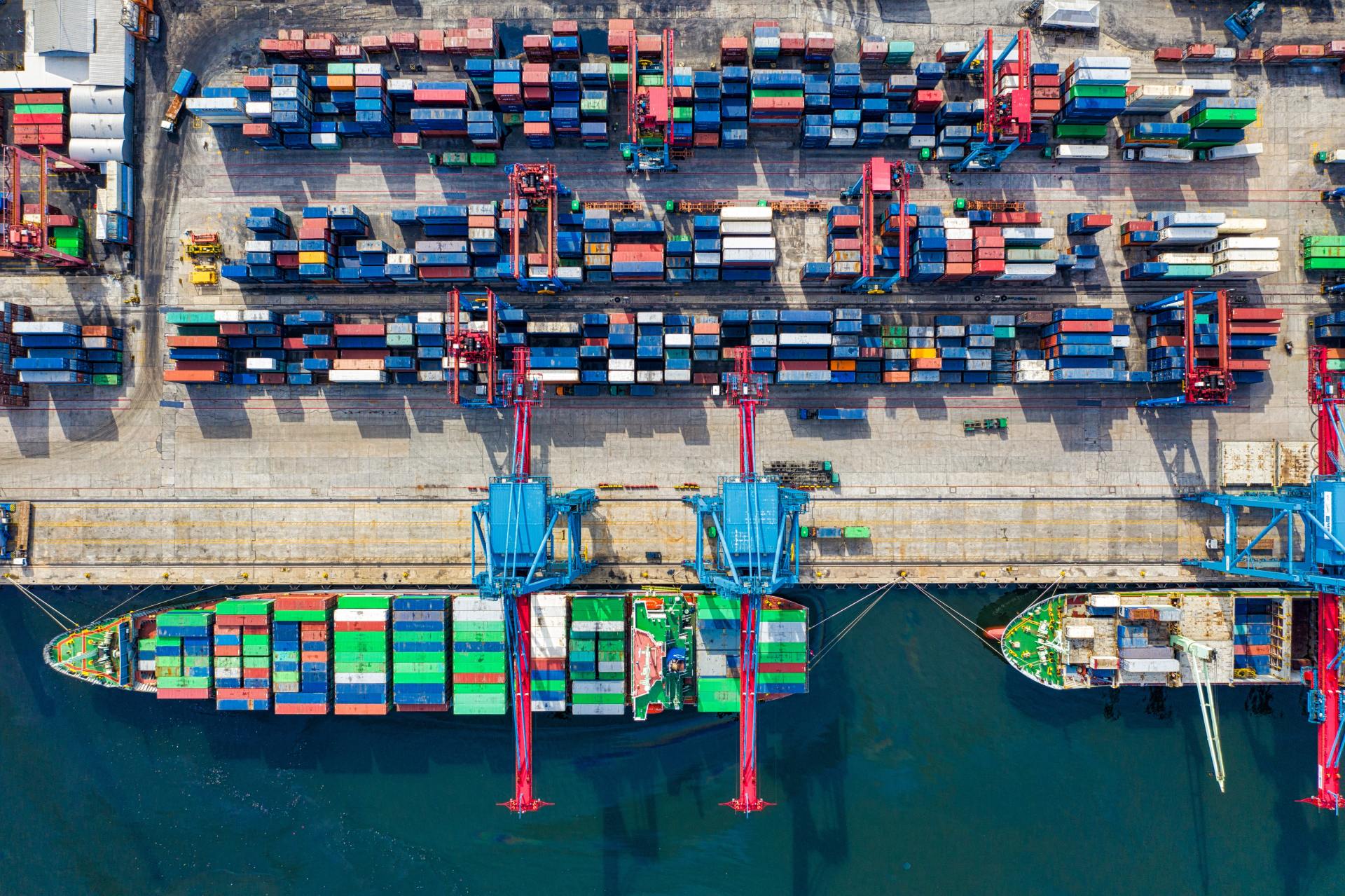

High freight costs undermining competitiveness of Australia’s agricultural commodities

A new report from AgriFutures Australia shows that freight costs are dampening the competitiveness of Australian agricultural commodities.

The research, produced under AgriFutures’ National Rural

Issues Program

, analyses the freight costs that Australian farm businesses

face when moving commodities from farm to processor, port or domestic market

across five major commodity groups including beef, milk powder, canola,

cherries and poultry.

It reveals that logistics are the largest single cost item in the production of many agricultural products, accounting for up to 48.5 per cent of farm-gate costs.

“In Australia, freight costs are highest for grains at 27.5 per cent of gross income, and fruit and vegetables at 21 per cent,” says John Harvey, Managing Director of AgriFutures Australia.

The report compares domestic analysis with international

agricultural supply chains to benchmark Australia’s performance on agricultural

transport costs against its global competitors.

“Knowing how much farmers pay for transporting their produce to consumers is crucial to measure the competitiveness of Australian farmers and to find out where the transport of agricultural goods faces pinch points and bottlenecks,” says Mr Harvey. “The report shows that Australia has comparatively higher freight costs for many of our key commodities compared to our international competitors and it’s hurting our bottom line.”

This research underlines the importance of improving transport efficiencies for agriculture by strategically investing in infrastructure. Establishing competitive modes of transport will ensure that Australian agriculture can reach its full export potential.

“Strategic planning and regulatory framework are required to

ensure infrastructure can be efficiently utilised by industry,” says Mr Harvey.

The National Farmers’

Federation

(NFF) has welcomed the research,

recognising the value of supply chain data for the agricultural sector.

“It is critical to look beyond the ‘now’ to consider future agricultural freight issues and to highlight possible options for potential improvement in transport infrastructure and regulation within the agricultural sector,” says Tony Mahar, CEO of the NFF.

One option for improving efficiency is to utilise air freight for transporting commodities. Agricultural producers can take advantage of enhanced air travel services and lower freight rates, especially given the depreciating Australian dollar.

Research

from Meat & Livestock Australia

shows

that air-freight trade is already being used by Australian sheep meat farmers

to meet high demand in the Middle East and North Africa, which represents

Australia’s largest chilled sheep meat export market. The rise of air-freight

trade to this region addresses the logistical challenges of supplying large

volumes of chilled sheep meat with strict shelf life thresholds through slower

sea-freight channels.

However, most airfreight is currently shipped through capital city airports, given few regional airports have the necessary aircraft and frequency required to offer significant regular freight capacity. The potential for air freight to improve the competitiveness of Australia’s exports will therefore depend on improving regional infrastructure close to food production areas.